How to Read Short Float % Properly Before Trading

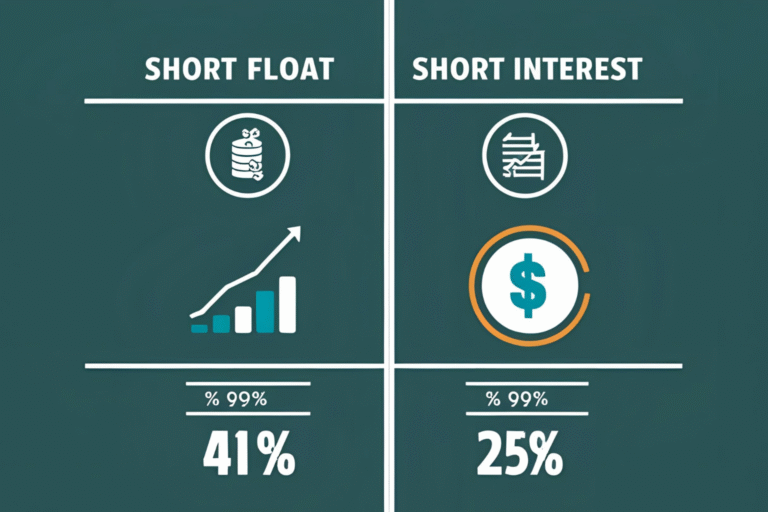

The short float percentage is a widely used metric among traders, but it’s also one of the most misunderstood. Simply seeing “25% short float” isn’t enough—you need to know what it means, how it’s calculated, and how to use it to identify risk and opportunity before entering a trade. What Is Short Float %? Short…