Is a High Short Float Bullish or Bearish? Explained

A high short float often sparks debate among traders. Is it a warning sign of impending downside—or a setup for an explosive short squeeze? The answer depends on timing, context, and market sentiment. In this post, we’ll break down when a high short float can be bearish, and when it turns bullish.

What Is Considered a High Short Float?

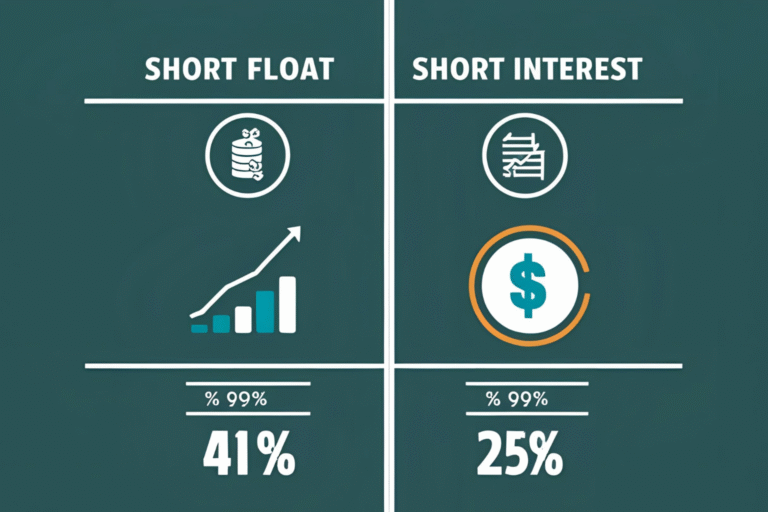

Generally, a stock is considered to have a high short float if more than 20% of its float is sold short. Some heavily shorted stocks can even cross 30% or 40%, drawing attention from both short-sellers and squeeze traders.

When High Short Float Is Bearish

- Weak Fundamentals

If a company has poor earnings, rising debt, or negative outlooks, high short float often reflects justified bearish sentiment. - Negative News Flow

Consistent bad press, legal trouble, or sector weakness can drive up short float levels, signaling downward pressure. - Low Institutional Support

When big players stay out, short-sellers may feel more confident in pressing the trade.

Key takeaway: A high short float in a weak company may indicate that downside risk is real and supported by fundamentals.

When High Short Float Is Bullish

- Short Squeeze Setup

A positive earnings report, news catalyst, or technical breakout can force short-sellers to cover quickly, driving price higher. - Retail Buying Momentum

When retail traders target a high short float stock (e.g., Reddit-fueled rallies), it can lead to massive upside—even if fundamentals are weak. - Contrarian Opportunity

Some traders view extreme bearishness as a contrarian buy signal, especially when there’s improving news or technical strength.

Key takeaway: A high short float becomes bullish only when buying pressure triggers panic short covering.

How to Know Which Side to Be On

Use these signals to decide:

- Bullish Signs:

- Positive news or earnings surprise

- Breakout above resistance with volume

- Technical strength and RSI divergence

- Bearish Signs:

- Declining earnings and revenue

- Weak chart structure

- No positive catalyst in sight

Real Example: GameStop (GME)

In early 2021, GME had a short float over 100%. While this was initially bearish, a massive retail buying campaign triggered a historic short squeeze, turning it into one of the most bullish trades in recent memory.

FAQs

Can a high short float mean both bullish and bearish outcomes?

Yes. It’s bearish if fundamentals are deteriorating, but bullish if a catalyst triggers panic buying from shorts.

Does a short squeeze always happen in high short float stocks?

No. Many highly shorted stocks continue to fall. A short squeeze needs a trigger—like news, earnings, or momentum.

What’s a dangerous short float level for shorts?

Anything above 25% combined with high volume and a strong technical breakout can be dangerous for short-sellers.

Is high short float good for day trading?

Yes, if there’s a catalyst or breakout, high short float stocks can offer fast-moving trading opportunities.

Should I avoid shorting high short float stocks?

If you’re a conservative trader, yes. They carry higher risk due to squeeze potential.