Reddit & Short Float Stocks: Hype vs Reality

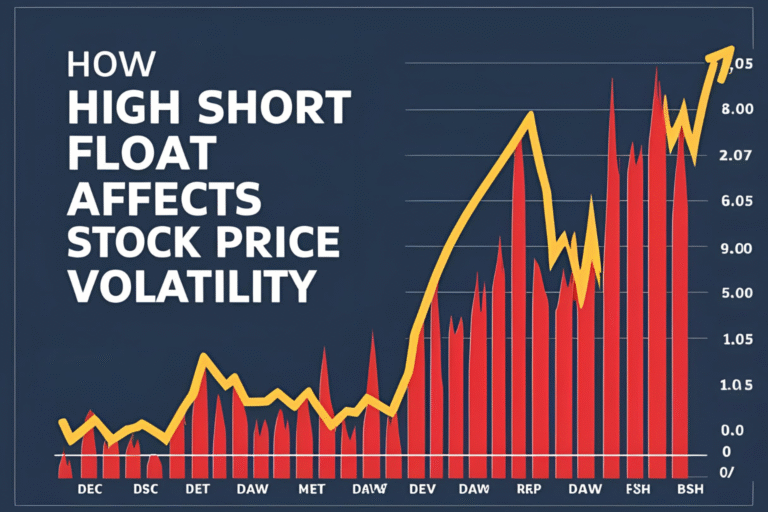

The rise of Reddit forums like r/WallStreetBets has turned the spotlight on short float stocks—transforming obscure tickers into high-profile trading battlegrounds. While social media can spotlight legitimate opportunities, it also creates a lot of hype. So how do you separate real trading signals from online noise?

How Reddit Influences Short Float Stocks

Reddit communities often target heavily shorted, low-float stocks in hopes of triggering a short squeeze. This strategy gained global attention during the GameStop (GME) saga in 2021 and continues today with various low-cap and meme stocks.

Key patterns:

- Focus on short float > 20%

- Viral posts and memes exaggerate buying pressure

- Group momentum attracts media and retail FOMO

- “Diamond hands” and “holding the line” themes fuel extended rallies

Examples of Reddit-Driven Short Float Stocks

| Ticker | Reddit Impact | Short Float (Est.) |

|---|---|---|

| GME | Original meme stock, historic squeeze | ~28% |

| AMC | Movie theatre chain, retail army support | ~22% |

| BBBY | High float with viral chatter | ~35% |

| KOSS | Headphones company with massive swings | ~30% |

The Hype: What to Be Cautious About

- No Real Catalyst

Just because it’s trending doesn’t mean there’s a fundamental or technical reason to buy. - Late Entry Risk

By the time a stock trends on Reddit, the initial move may be over. - Manipulative Behavior

Some users push stocks for personal gain without disclosing positions. - Volatility and Reversals

Massive spikes often lead to equally large crashes.

The Reality: When Reddit Calls Get It Right

There are times when Reddit-fueled trades are valid:

- A real catalyst exists (e.g., earnings beat, insider buying)

- The short float is very high with low float supply

- Technical chart setups align with volume surges

- Institutions or filings confirm upward trend

The key: Combine Reddit sentiment with actual data and chart analysis.

Tools to Evaluate Reddit Stocks

- SwaggyStocks – Tracks most mentioned stocks on Reddit

- Fintel – Shows short float, borrow data, and squeeze risk

- Ortex – Provides real-time squeeze potential and short float estimates

- Reddit Search – Use advanced search to find most upvoted recent posts with DD (due diligence)

Smart Trader Tips

- Don’t rely on Reddit alone—verify all data

- Avoid buying into vertical spikes—wait for pullbacks or consolidations

- Track volume and news before taking action

- Treat meme stocks as high-risk trades with proper stop-loss rules

FAQs

Are Reddit short float stocks always risky?

Yes. They often have extreme volatility and unpredictable behavior due to crowd-driven trading.

Can Reddit actually cause a short squeeze?

Yes—if the stock is heavily shorted and the retail buying is sustained, it can pressure shorts into covering.

How do I know if a Reddit stock has potential?

Check the short float %, float size, volume trend, and whether any news supports the rally.

Should I hold a Reddit stock long-term?

Rarely. Most are best treated as short-term speculative trades unless backed by strong fundamentals.

What’s the best way to monitor Reddit stock sentiment?

Use tools like SwaggyStocks or track r/WallStreetBets, r/stocks, and r/squeezemetrics manually.