How Short Float Impacts Earnings Season Volatility

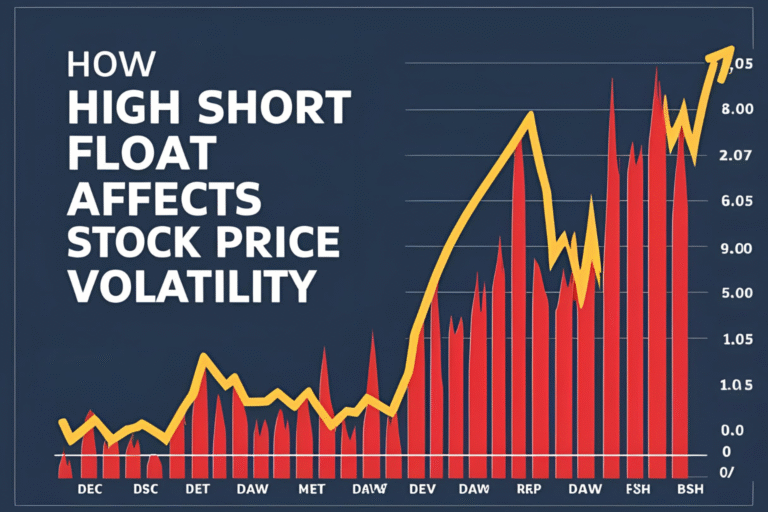

Earnings season is already a high-volatility period—but when you mix in a high short float, the stakes become even higher. Traders and institutions pay close attention to short float levels heading into earnings announcements because they can dramatically amplify price movements in both directions.

Why Earnings + High Short Float = Big Moves

When a stock with a high short float reports earnings, two major outcomes can occur:

- Better-than-expected results trigger short covering, leading to a fast upward spike.

- Worse-than-expected results confirm bearish bets and often cause a steep sell-off.

In either case, volatility increases significantly because of position rebalancing, liquidity pressure, and trader reactions.

Common Scenarios During Earnings

1. Short Squeeze on Positive Surprise

A stock with 30% short float beats earnings. Shorts rush to cover, and the buying frenzy drives prices even higher.

2. Crash on Negative Results

A stock with 25% short float misses earnings and lowers guidance. Bears gain confidence, and longs exit quickly—resulting in a sharp drop.

3. Volatility Spike Without Directional Follow-Through

Sometimes, even flat results in high short float stocks can lead to sharp intraday spikes and reversals as traders unwind positions.

How to Trade High Short Float Stocks Around Earnings

- Plan Before the Report: Enter with a clear plan or avoid holding through the announcement.

- Use Options (if experienced): Straddles or strangles can capture volatility without picking a direction.

- Avoid Overexposure: Use reduced position sizes due to the binary nature of earnings.

- Look for Volume + Gap Plays: Post-earnings price gaps with rising volume can trigger extended moves or reversals.

Real Example: AMC Earnings

In past earnings seasons, AMC had a short float over 20%. Positive results and increased retail attention caused short covering, resulting in a 30%+ price jump in a single session. Those who monitored short float data beforehand were better prepared for this outcome.

Tools to Monitor Ahead of Earnings

- Finviz Earnings Calendar – Filter by short float %

- Ortex – Monitor live short interest and borrow rate changes pre- and post-earnings

- Yahoo Finance – Look under “Statistics” for short float and “Earnings” tab for dates

FAQs

Should you trade high short float stocks during earnings?

Only if you’re experienced and manage risk well. The volatility is attractive but risky.

Does short float always lead to a squeeze after earnings?

No. A squeeze only happens if the news surprises to the upside and triggers short covering.

Is it better to buy before or after earnings in high short float stocks?

After earnings is generally safer, as the direction is known. Pre-earnings trades are speculative.

What’s a safe short float % going into earnings?

Below 10% usually signals lower squeeze or crash risk.

Can options volume predict short float moves around earnings?

Unusual options activity often aligns with short float-driven volatility, especially when call volume spikes pre-earnings.