Short Float in Penny Stocks: What to Watch Out For

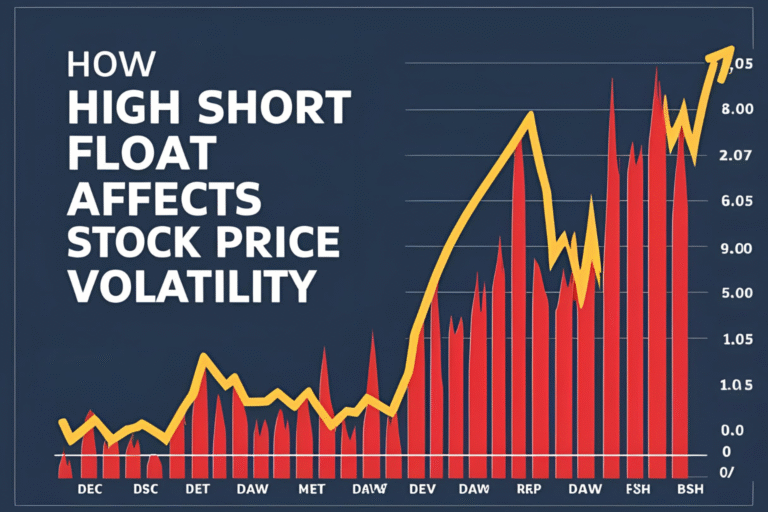

Penny stocks are known for high volatility and low liquidity—and when you add short float into the mix, the risk and reward potential multiplies. Many traders are drawn to short float penny stocks for their explosive upside potential, but it’s important to understand what makes them so unpredictable and how to approach them carefully.

Why Short Float Matters in Penny Stocks

Short float indicates the percentage of a stock’s tradable shares that are sold short. In penny stocks, the float is often very low, so even a small short position can push the short float percentage sky-high. This creates the perfect setup for massive price swings—up or down.

Risks of Trading Short Float Penny Stocks

- Extreme Volatility

Prices can double or drop 50% in a single session due to low volume and heavy short covering. - Low Liquidity

Even small buy/sell orders can impact price. Getting in is easy—getting out is not. - Pump-and-Dump Scenarios

Many penny stocks with high short float are targets for manipulation or hype-driven runs. - False Breakouts

Squeezes may start fast but fizzle out, trapping traders in losing positions.

What to Watch For Before Trading

- Short Float Above 20%

Indicates high bearish sentiment and squeeze potential. - Daily Volume vs Float

If daily volume exceeds float multiple times, a squeeze could be forming. - Recent News or Filings

Even small updates (like funding, partnerships) can act as a catalyst for a short squeeze. - Social Media Buzz

Many penny stock squeezes are retail-driven via Reddit, Discord, and Twitter.

Real-World Example

A penny stock with:

- Float: 5 million shares

- Short Interest: 1.5 million shares

- Short Float: 30%

If unexpected news drops, and the stock gets volume from retail traders, it could trigger a rapid squeeze that sends the price up several hundred percent in hours.

Tips for Trading Penny Stocks with High Short Float

- Use smaller position sizes

- Avoid chasing parabolic moves

- Set hard stop-loss levels

- Never trust hype without verifying news

- Use real-time volume and float trackers like Fintel or Finviz

FAQs

Are short float penny stocks safe to trade?

No. They are high-risk, speculative plays. Only trade them with strict risk management.

What makes penny stocks with high short float attractive?

The potential for massive short squeezes due to low float and crowd-driven buying.

Can institutions short penny stocks?

Rarely. Most institutional shorts focus on larger-cap stocks with more liquidity.

How do I know if a penny stock is being pumped?

Look for exaggerated claims, anonymous promotions, or unusual volume without news.

What platform is best for tracking penny stock float and short interest?

Finviz (free), Fintel (paid), and Ortex (advanced) offer reliable data.