Short Squeeze Explained: Role of Short Float

A short squeeze is one of the most dramatic price events in the stock market—causing sharp upward moves that defy fundamentals. At the core of almost every short squeeze is a high short float. In this article, we explain how short float contributes to a squeeze, the warning signs, and how traders try to capitalize on it.

What Is a Short Squeeze?

A short squeeze occurs when a heavily shorted stock starts rising in price, forcing short-sellers to buy back their shares to limit losses. This buying pressure from shorts, combined with new interest from bullish traders, pushes the stock even higher in a feedback loop.

The Role of Short Float in a Short Squeeze

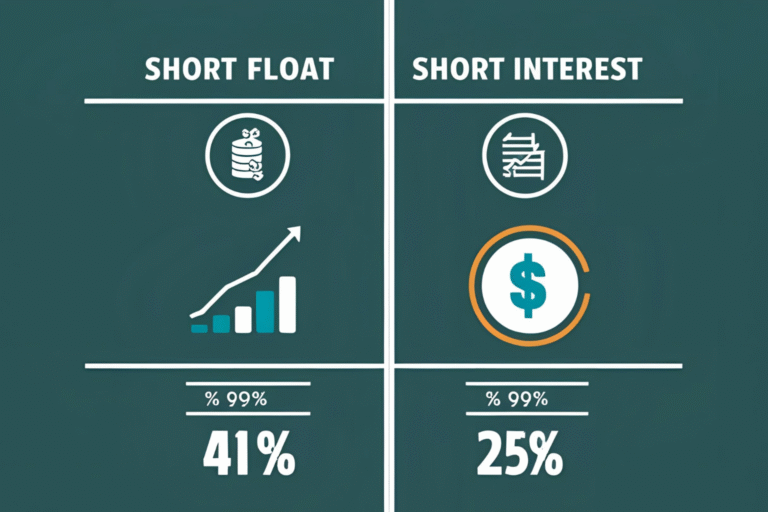

Short float measures the percentage of a stock’s tradable float that is currently sold short. The higher the short float, the more likely a squeeze could occur—especially if there’s positive news or a technical breakout.

| Short Float % | Squeeze Risk |

|---|---|

| Under 10% | Low risk |

| 10–20% | Moderate potential |

| Over 20% | High squeeze risk |

| 30%+ | Extremely high risk |

Triggers That Cause Short Squeezes

- Positive Earnings Surprises

- Upgrades from Analysts or Institutions

- Unexpected News (M&A, product success)

- Technical Breakouts with High Volume

- Retail Buying Frenzies (e.g., Reddit stocks)

Once the price starts to rise rapidly, shorts begin to cover, which causes the price to spike further—fueling a squeeze.

Real-Life Example: GameStop (GME)

In early 2021, GME had a short float over 100% due to synthetic shorts and misaligned borrow data. Once retail traders pushed prices higher, shorts rushed to exit, creating a historic squeeze that saw the stock rise from under $20 to over $400 in a few days.

How to Spot a Potential Squeeze

- High Short Float (20% or more)

- Low Float Stock (supply is limited)

- Volume Surge + Price Breakout

- Bullish News or Hype Cycle

- Borrow Rates Increasing (shorting cost rising)

Watch platforms like Fintel, Ortex, and Finviz to track these signals in real time.

Trading Tips for Short Squeeze Setups

- Enter early on breakout or catalyst

- Avoid chasing after the peak

- Use tight stop-losses due to volatility

- Never short-sell a stock with high squeeze potential

FAQs

Is short float required for a short squeeze?

Yes. A short squeeze can only happen when a significant percentage of shares are shorted.

Can a low-float stock have a squeeze?

Yes. Low float combined with moderate short float can still cause sharp squeezes due to limited supply.

How long do short squeezes last?

Some last hours, others days. It depends on news, volume, and how quickly shorts exit.

Are all squeezes caused by retail traders?

Not always. Institutions can participate, and sometimes they initiate squeezes using large options activity or volume spikes.

Where can I track short squeeze candidates?

Use Finviz (free), Fintel (squeeze leaderboard), or Ortex (paid, real-time data).